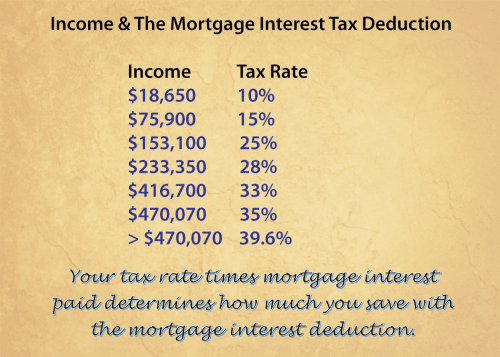

25+ tax on mortgage payments

Web 20 Down Payment. Web If the mortgage closes on Jan.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

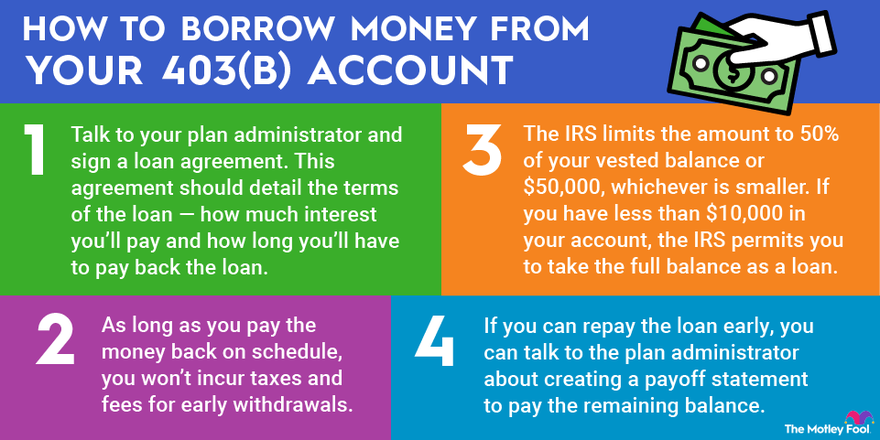

Web 1 day agoIn 2023 the maximum amount of money you can save in most workplace retirement amounts pretax will be 22500 up from 20500 in 2022.

. Web Equation for mortgage payments M P r 1 r n 1 r n - 1 This formula can help you crunch the numbers to see how much house you can afford. Web The typical monthly principal and interest payment on a 30-year fixed-rate loan for a median-priced 350300 home in January 2022 with a 10 down payment was. In some cases borrowers may put down as low as 3.

A 1000 tax deduction would lower their taxable income from 67000 to 66000 -- at the expected. Never spend more than 25 of your monthly take-home. 25 you owe 16110 for the seven days of accrued interest for the remainder of the month.

Web If your mortgage servicer did not pay your taxes you should send a copy of the bill along with a notice of error which is a letter disputing the error to your mortgage servicer. Web Most lenders require private mortgage insurance or PMI when a buyer cannot make a down payment of at least 20 of the purchase price. Access Our Tax Estimator Tools At Anytime Anywhere.

If you have an escrow account you. For example if you earn. Web Generally the interest portion of your monthly mortgage payment is tax deductible.

Its Who We Are. Figure out 25 of your take-home pay. Web For most borrowers the total monthly payment sent to your mortgage lender includes other costs such as homeowners insurance and taxes.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. If the borrowers make a down.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Homeowners who put less than 20 down on a conventional loan. Lowest Rates Easy Online Process.

Mortgages Arent Just What We Do. On a 300000 fixed-rate 30-year mortgage the average rate is 641. Comparisons Trusted by 55000000.

Its Who We Are. Mortgages Arent Just What We Do. Ad Quickly Calculate Your Tax Refund So You Know What To Expect.

Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Apply Now With Quicken Loans. Annual interest rate for this mortgage.

Web While some homeowners would rather pay property taxes themselves rolling your tax payment into your mortgage payment allows you to avoid shelling out. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. The next monthly payment the full.

Ad Calculate Your Payment with 0 Down. Web A 1000 tax credit would reduce their total tax bill to 9000. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Home buyers who have a strong down payment are typically offered lower interest rates. Apply Now With Quicken Loans. Best Mortgage Lenders in Washington.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees. Get a clear breakdown of your potential mortgage payments with taxes and insurance. Web Check out the webs best free mortgage calculator to save money on your home loan today.

To calculate how much house you can afford use the 25 rule. Ad 5 Best Home Loan Lenders Compared Reviewed. Get Prepared To File Your Taxes.

The coverage protects the lender in. See Your Estimate Today. Mortgage discount points optional extras that you pay to reduce your mortgage rate when you set up a home loan are also generally tax deductible.

Web The higher your score the lower the interest rate youll be charged. Web This mortgage calculator will help you estimate the costs of your mortgage loan. Ad Compare Mortgage Options Calculate Payments.

Web The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage payment. Web 25 Post-Tax Model. Enter an amount between 0 and 25.

Ad Compare Mortgage Options Calculate Payments.

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books

Top 8 Stock Market Apis For Developers In 2023 78 Reviewed

Tips To Maximise Your Small Business Tax Return

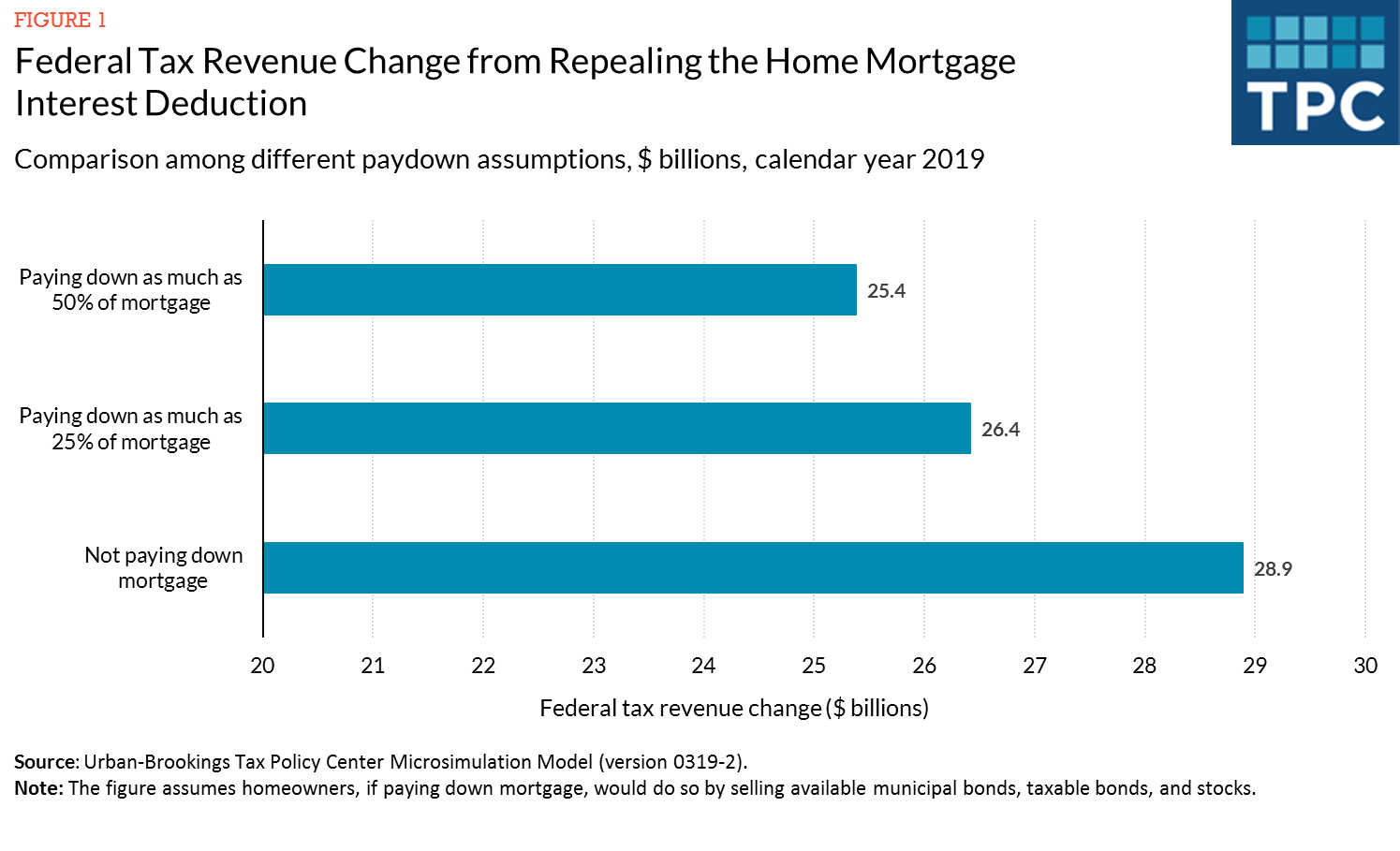

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

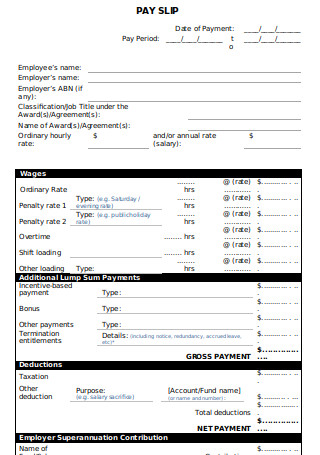

25 Sample Payroll Slip Templates In Pdf Ms Word

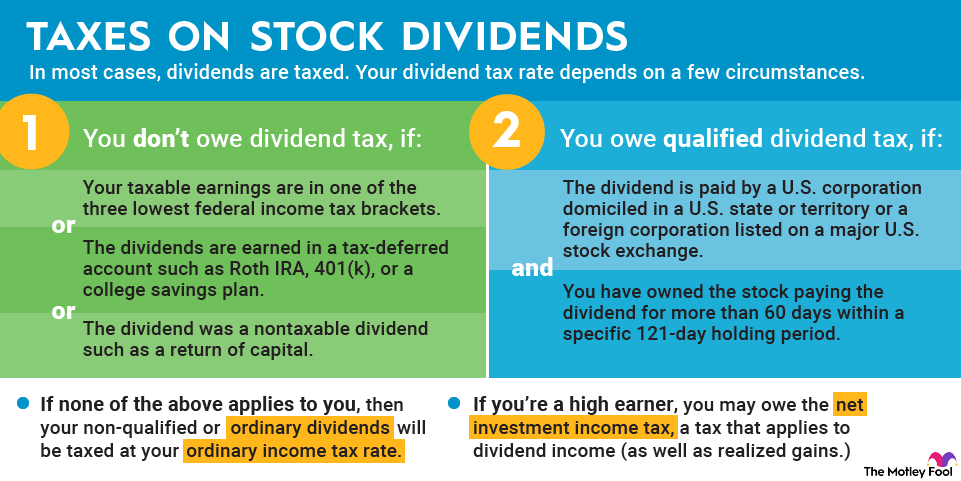

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Tax Loss Carry Forward How Does Tax Loss Carry Forward Work

G145441mmi022 Jpg

Bpr Booklet

Languedoc Pages July 2012 By English Language Media Sarl Issuu

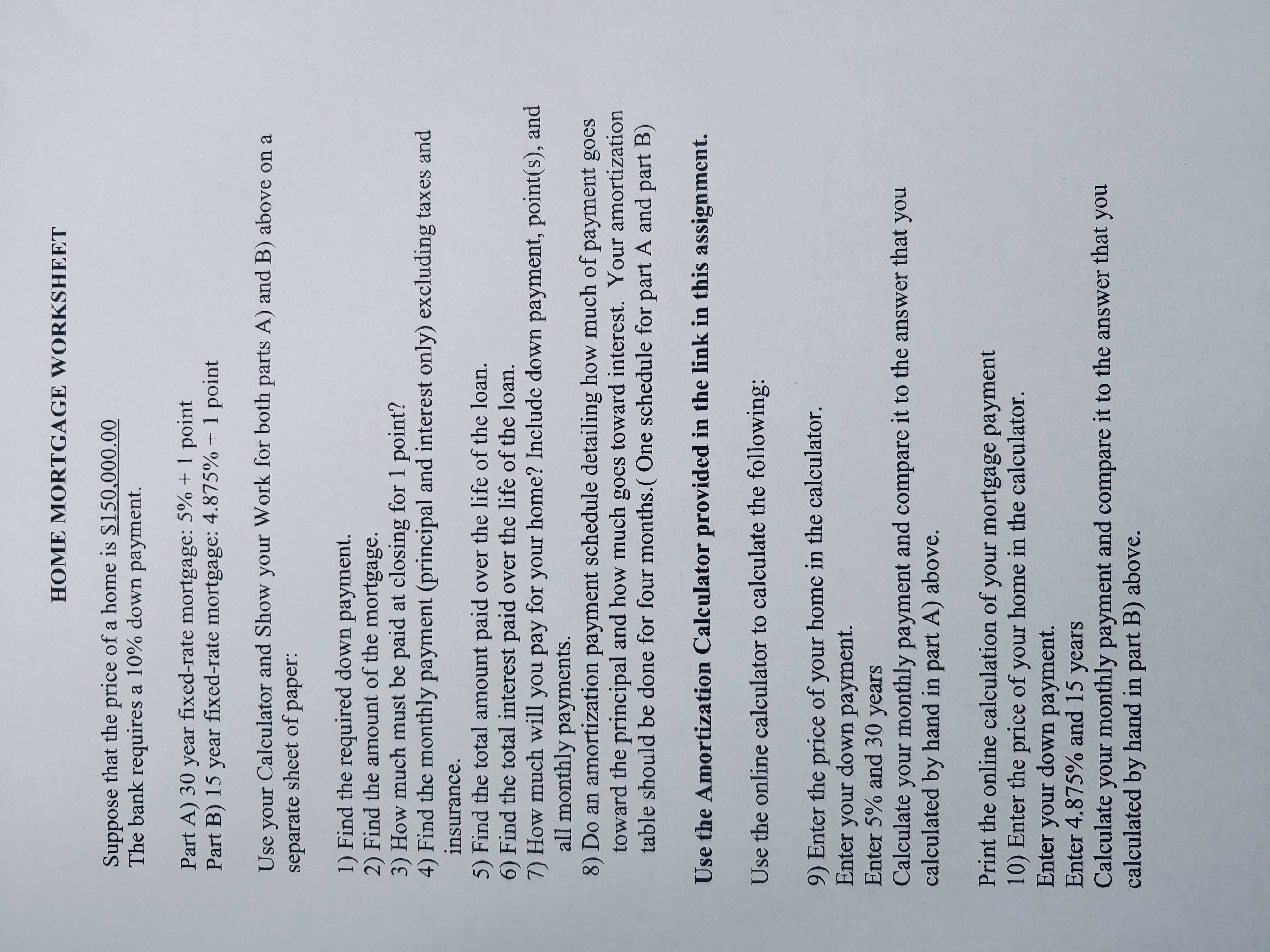

Answered Suppose That The Price Of A Home Is Bartleby

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Home Loan Tax Benefit Calculator Income Tax Saving Calculator Bajaj Finserv

It S Time To Gut The Mortgage Interest Deduction

Top 25 Mortgage Brokers In Melbourne 2023