Home loan tax saving calculator 2020

HELOC interest rates on the other hand are variable and can be somewhat higher depending on the bank and the prime rate. In case of a joint home loan ensure you are the houses co-owner.

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Compare home loan rates from over 120 lenders.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

. Section 80 Deductions. Check your tax code - you may be owed 1000s. You can take the loan for 90 to 100 of the on-road price of the car.

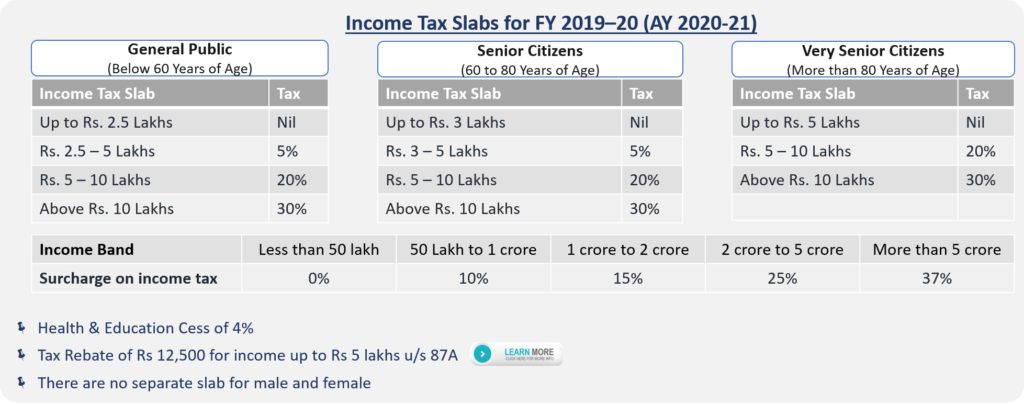

You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. Current home equity loan rates.

The Sales Tax Deduction Calculator IRSgovSalesTax. 2 lakh on their home loan. Income Tax Saving on Home Loan for FY 2020-21 AY 2021-22 Who can claim tax benefit on home loan.

3Reduce tax if you wearwore a uniform. Amount of Income Tax Deduction for Payment of Housing Loan Interest us 24. 15 lakh on the principal repayment and Section 24Bs deduction of Rs.

Compare top-rated home loans starting at 314 comparison rate 306 from over 120 lenders. Hand over the home loan interest certificate to your employer for adjusting the TDS. When you borrow to prepay your home loan.

Conditions for claiming home loan deduction under 80C. Find out the deduction under section 80c for FY 2020-21 AY 2021-22. As per the Income Tax Act of 1961 you can get annual home loan tax benefit via both the interest and principal components of the loan.

Apply for housing finance and enjoy home loan tax benefits with Tata Capital. Where P Principal amount N Loan tenor in months and R Monthly interest rate If the annual rate of interest is 6 the value of R will be 612 x 100 0005. 4Up to 2000yr free per child to help with childcare costs.

Home loan tax benefits include Section 80Cs deduction of Rs. Section 80C allows for a deduction of Rs15 lakh towards principal repayment and Section 24B allows for a deduction of Rs2 lakh on the basis of interest repayment. Earn 100 switching bank.

Calculate the total amount you can claim as a tax deduction. Car Loan - With interest rates as low as 700 pa. And a repayment tenure of up to 8 years you can find the most suitable car loan for your needs at BankBazaar.

Formula for EMI Calculation is P x R x 1RN 1RN-1. While on adjustable rate home loans there are no prepayment charges on fixed rate home loans lenders usually charge a penalty of 2 percent of the amount being prepaid through refinance ie. Quickly find a home loan to suit your needs whether youre looking to invest refinance or buy a home.

Suppose this person made a prepayment of Rs150000 in the first 12th month. This implies that if two individuals have applied for a joint home loan each can claim tax benefit of up to Rs. Consider the above case where a person took home loan of Rs30 lakhs 85 pa for 20 years.

Final Thoughts The subsidies on housing finance are encouraging. 5Take home over 500mth. Free tax code calculator.

The above calculator provides for interest calculation as per Income-tax Act. 15000 750000 up to 1 million for properties in California Up to 30 years. LENDER APR LOAN AMOUNT RANGE LOAN TERMS MAX LTV.

Financial analysis is provided for an initial period selected by the user subsequent years throughout the duration of the loan term. Additional Read- Common Myths About Home Loan. 15 lakh and Rs.

Make sure you are on track to meet your investing goals. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR. Home equity loan interest rates are typically on par with mortgage loan rates.

150000 in a financial year from your taxable income through investments in various. Make sure the residential property is in your name. Individuals taking a home loan jointly can avail home loan tax benefits individually.

The decision to prepay your home loan should be considered after accounting for the cost of prepayment. Applying for a home loan jointly not only enhances your home loan eligibility but also the tax benefits. To do so you must have e-filed your original 2019 or 2020 return.

In most cases they can be the same since all three loans work off the same basic set of information like amount borrowed prepayments tenure interest rates and processing fee however with some calculators there could be a restriction placed on the amount to borrow based on the type of loan. The main tax reliefs are listed under Section 80C and Section 24B. Due to this prepayment he could save Rs534832 on interest.

Tax-Saving Mutual Funds ELSS Section 80C of the Income Tax Act 1961 allows you to avail deductions of up to Rs. The aforementioned sections are predominantly created for housing loan-related tax benefits whereas Section 80C has a more generalised tax-saving outlook. Know more how you can save tax with ICICIdirect through Tax-Saving Mutual Funds National Pension Schemes Life Insurance and Health Insurance.

The law changed how mortgage debt is treated based on how loan proceeds are used. Understanding the Income Tax Implications of Tapping Home Equity. Income Tax Deduction for Home Loan Repayment of Principal Amount us 80C.

The process to claim tax benefits on a home loan is easy and simple. Compare Best Car Loan Interest Rates in. Are the calculators for home car and personal loans the same.

Costs for home testing and personal protective equipment PPE for COVID-19. 2Transfer unused allowance to your spouse. Explore personal finance topics including credit cards investments identity.

You can also calculate the EMI on home loan manually using the below formula. Tax Benefits on Home Loan for 202210003 Principal amount- Section 80C 10003 Deductions- Section 80EE 10003 Interest payment Section 24b. Current home equity loan interest rates range from 415 to 1300 among the banks we reviewed.

Our homeownership tax benefits guide includes a more detailed calculator which enables users to input more data to get a more precise calculation has been updated to include 2020 standard decutions and the new. You can also claim house loan tax deductions for registration fees and stamp duty charges under Section 80C. A complete guide on Income Tax deduction under section 80C 80CCD1 80CCD1B 80CCC.

Prior to the passage of the Tax Cuts and Jobs Act of 2017 interest on up to 100000 of second mortgage debt via home equity loans or HELOCs was tax deductible no matter how the money was used. FAQs on EMI Calculator. Yes you can get tax deductions on home loan repayment.

2 lakh on the interest repayment.

Simple Interest Calculator Audit Interest Paid Or Received

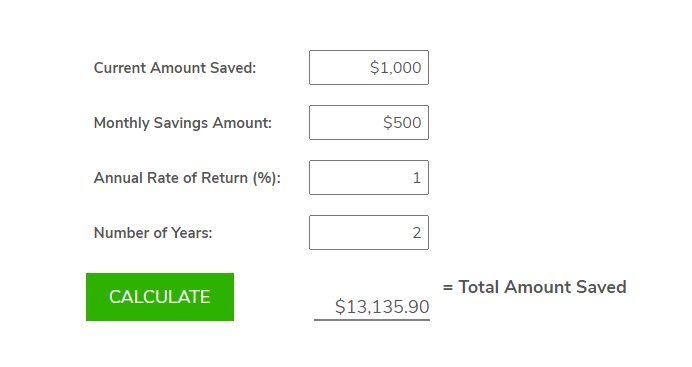

Free Simple Savings Calculator Investinganswers

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Section 80ee Deduction For Interest On Home Loan Tax2win

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Home Loan Tax Benefit Calculator Housing Loan Tax Saving Calculator Indiabulls Home Loan

Advisorsavvy Calculators

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Home Loan Tax Benefit Calculator Housing Loan Tax Saving Calculator Indiabulls Home Loan

Home Loan Emi Calculator 2022 Free Excel Sheet Stable Investor

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Tax Shield Formula Step By Step Calculation With Examples

Click Here To View The Tax Calculations Income Tax Income Online Taxes